Portfolio Optimization and Performance Analysis

December 15, 2020

2 min read

Project

This project, developed as part of my Master's thesis in Finance, marked my first foray into exploring cryptocurrency markets, simulations, and research. It played a fundamental role in sharpening my skills in data analysis, coding, and research by bridging advanced financial theory with real-world applications.

This project, developed as part of my Master's thesis in Finance, marked my first foray into exploring cryptocurrency markets, simulations, and research. It played a fundamental role in sharpening my skills in data analysis, coding, and research by bridging advanced financial theory with real-world applications.

Key Highlights

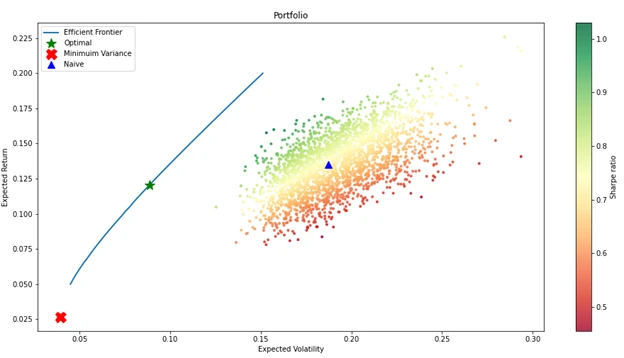

- Portfolio Optimization: Employed Monte Carlo simulations, efficient frontier construction, and optimization techniques to identify maximum Sharpe ratio and minimum variance portfolios.

- Performance Metrics: Analyzed risk-adjusted performance with metrics like Sharpe Ratio, Treynor Ratio, Jensen's Alpha, and Beta.

- Data Visualization: Created visualizations including efficient frontier plots, allocation charts, and correlation matrix heatmaps.

- Statistical Testing: Conducted rigorous T-tests to compare portfolio strategies and validate performance.

Challenges Addressed

Several challenges were overcome during this project:

- Managing and processing complex financial datasets.

- Integrating theoretical finance with practical Python-based applications.

- Ensuring statistical robustness in comparing various portfolio strategies.

Practical Applications

- For Investors: Enhance portfolio strategies through optimization and advanced risk-return analyses.

- For Researchers: Use the project as a basis for exploring sophisticated portfolio theories.

- For Learners: Gain hands-on experience with financial modeling and visualization using Python and its data analysis libraries.

Explore the full code and visualizations on GitHub .

FinancePythonData Analysis